Will Hong Kong 50 Index have enough momentum to break resistance?

Hong Kong 50 Index is heading towards the resistance line of a Channel Down. If this movement continues, the price of Hong Kong 50 Index could test 17195.6192 within the next 3 days. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding just like […]

Big movement possible on Hong Kong 50 Index

Hong Kong 50 Index has broken through a support line. It has touched this line numerous times in the last 16 days. This breakout shows a potential move to 16916.8711 within the next 3 days. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

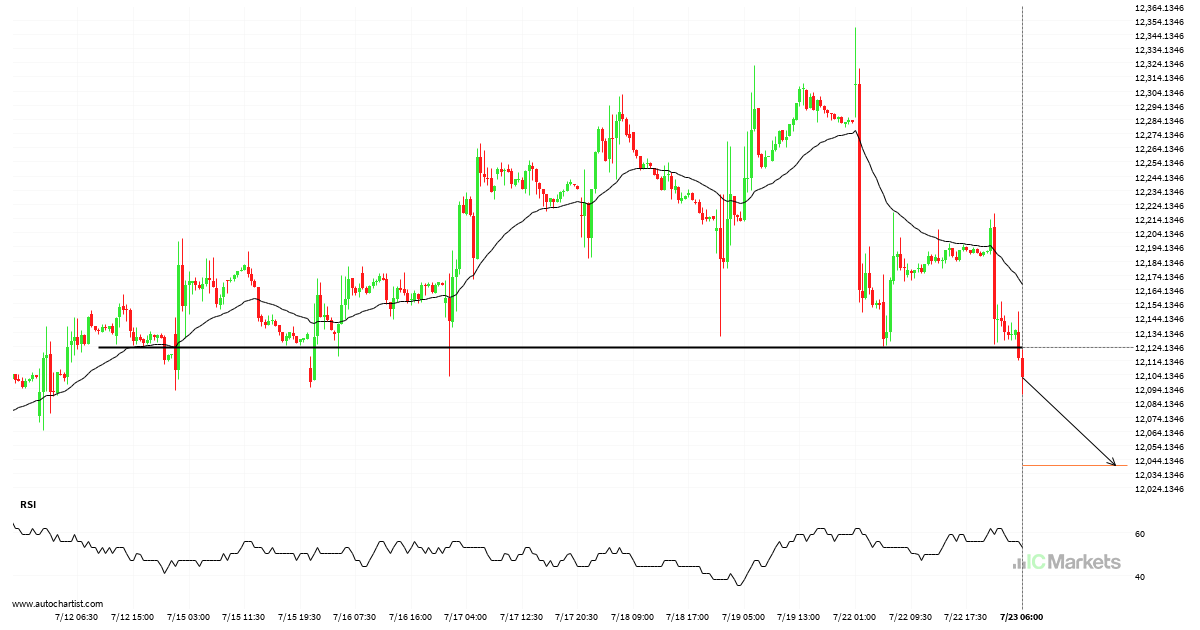

FTSE China A50 Index broke through important 12123.0498 price line

The breakout of FTSE China A50 Index through the 12123.0498 price line is a breach of an important psychological price that is has tested numerous in the past. If this breakout persists, FTSE China A50 Index could test 12040.2188 within the next 2 days. One should always be cautious before placing a trade, wait for […]

Breach of important price line imminent by FTSE China A50 Index

The movement of FTSE China A50 Index towards 11965.6797 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 3 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound back […]

Australia 200 Index experienced an exceptionally large movement

Australia 200 Index has experienced an exceptionally large movement lower by 0.84% from 7968.7 to 7901.7 in the last 15 hours.

Breach of important price line imminent by Hong Kong 50 Index

The movement of Hong Kong 50 Index towards 17584.2891 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 3 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound back […]

Resistance breakout on FTSE China A50 Index

FTSE China A50 Index is once again retesting a key horizontal resistance level at 12202.7305. It has tested this level 7 times in the recent past and could simply bounce off like it did last time. However, after this many tries, maybe it’s ready to start a new trend.

FTSE China A50 Index trade outlook at 2024-07-15T18:00:00.000Z until 2024-07-15T18:00:00.000Z

The last 7 1 hour candles on FTSE China A50 Index formed a Rising Wedge pattern and broken out through the pattern lines, indicating a possible bearish movement towards the price level of 12108.2736.

Hong Kong 50 Index trade outlook at 2024-07-12T03:00:00.000Z until 2024-07-12T03:00:00.000Z

The last 18 1 hour candles on Hong Kong 50 Index formed a Channel Down pattern and broken out through the pattern lines, indicating a possible bullish movement towards the price level of 18407.1934.

Continuation pattern on Hong Kong 50 Index

Triangle pattern identified on Hong Kong 50 Index has broken through a resistance level with the price momentum continuing to move in an upward direction. A solid trading opportunity continues with the price expected to reach 17817.1177 in the next 19.